U.S. Customer Satisfaction Growth Stagnates

Q2 2024: The American Customer Satisfaction Index (ACSI)

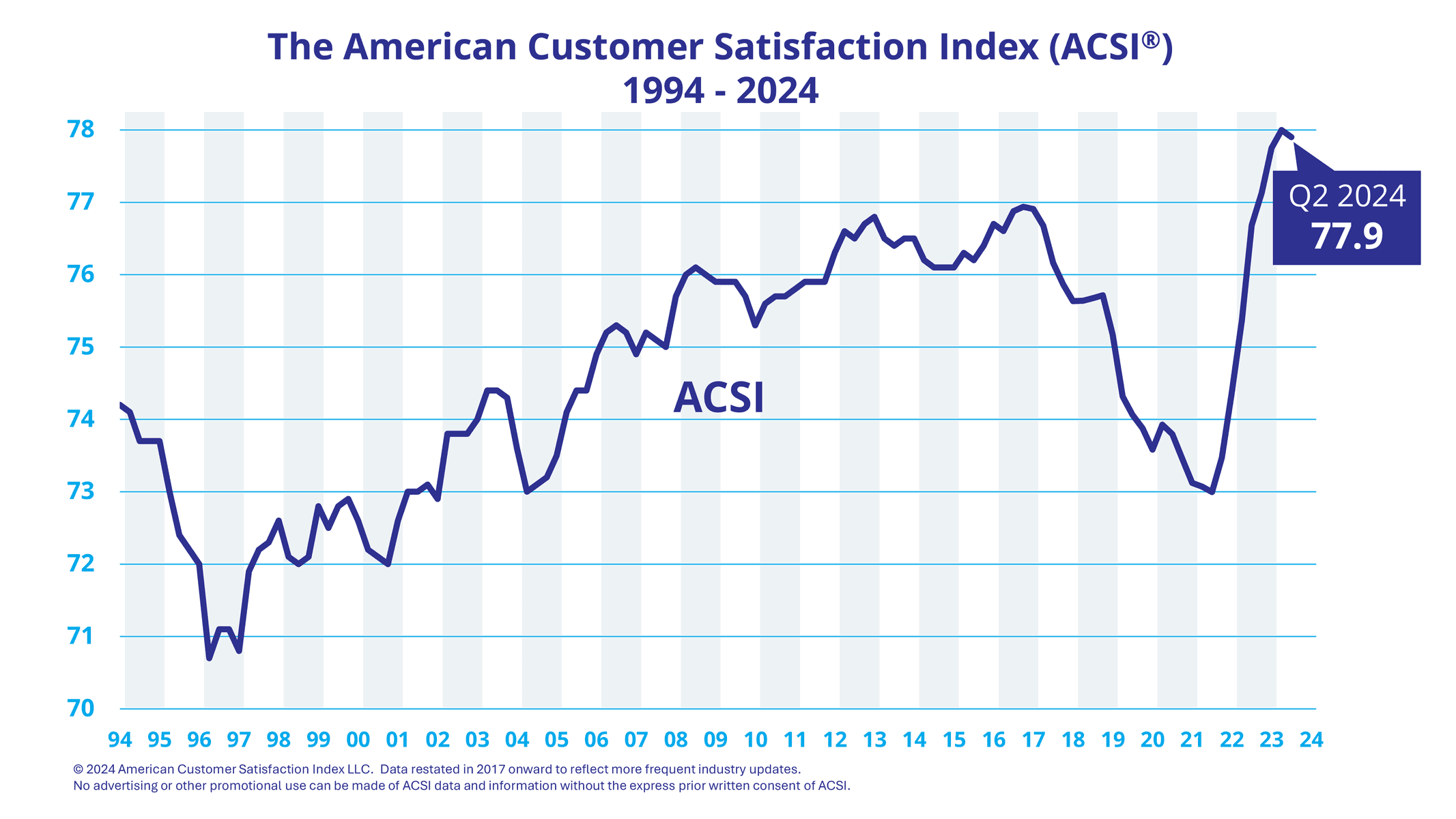

The sharp recovery in the quality of U.S. economic output over the past two years as measured by the American Customer Satisfaction Index (ACSI®) is now stagnating. At the national level, customer satisfaction is down by 0.1% in the second quarter of 2024 to an ACSI score of 77.9 (on a 0-100 scale). Even though there has been a large increase in customer satisfaction over the past two years, it is not much higher now than it was in 2013, more than 10 years ago.

While some companies have managed to significantly improve the satisfaction of their customers over the past decade – and benefited from it financially – many have not. Despite large corporate investments in Customer Experience Management over the past decade, there has only been a marginal increase in the national ACSI score.

There are several reasons for this, but rising customer expectations, an often-suggested culprit, is not one of them. ACSI data show that customer expectations are almost always higher than their subsequent satisfaction, but the gap has remained unchanged over the years. Business lack of data about consumers is not a problem either. Companies have more data on their customers today than ever before. But data need processing and powerful analytics. Consumer data are noisy, highly collinear, and do not follow standard probability distributions. There are methods for handling this, but they remain mostly absent in company customer data analytics.

Strong and increasing levels of customer satisfaction improve customer loyalty, which has an exponentially cumulative effect on profit. By definition, loyal customers also lower business risk, and low risk/high return leads to long-term profitability. In the aggregate, it also has a positive effect on the economy. Although the national ACSI score is only up marginally from a decade ago, it is nevertheless near record levels. The economy has been strong with solid GDP growth, inflation decline, robust consumer spending, and exceptional employment growth.

Consistent with the present lack of growth in customer satisfaction, however, there are now signs that household spending is slowing and that consumers are becoming more budget conscious. This may well lead to a reduction in consumer spending growth, the largest component of GDP. If so, some industries are now more vulnerable than others. Just as price elasticity varies across industries, so does quality (satisfaction) elasticity. Companies in industries with high elasticity have the most to gain from positive changes in customer satisfaction, but also have the most to lose from negative changes. According to ACSI data, among the high-elasticity industries are credit unions, banks, subscription TV providers, internet service providers, and financial advisors. Gas stations and supermarkets are on the opposite side of the spectrum. It is not that companies in these industries are immune to declining customer satisfaction, but the effect of it would be less dramatic.

As the quality of economic output, as judged by those who consume it, stagnates or deteriorates, consumer spending may follow suit with negative consequences for further economic growth, as well as for labor and equity markets. The U.S. economy is not there yet, but there are warning signals.

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | |

|---|---|---|---|---|

| 2024 | 78.0 | 77.9 | ||

| 2023 | 75.4 | 76.7 | 77.1 | 77.8 |

| 2022 | 73.1 | 73.0 | 73.5 | 74.4 |

| 2021 | 73.9 | 73.8 | 73.5 | 73.1 |

| 2020 | 74.3 | 74.1 | 73.9 | 73.6 |

| 2019 | 75.6 | 75.7 | 75.7 | 75.2 |

| 2018 | 76.7 | 76.2 | 75.9 | 75.6 |

| 2017 | 76.6 | 76.9 | 76.9 | 76.9 |

| 2016 | 76.3 | 76.2 | 76.4 | 76.7 |

| 2015 | 76.2 | 76.1 | 76.1 | 76.1 |

| 2014 | 76.5 | 76.4 | 76.5 | 76.5 |

| 2013 | 76.6 | 76.5 | 76.7 | 76.8 |

| 2012 | 75.9 | 75.9 | 75.9 | 76.3 |

| 2011 | 75.6 | 75.7 | 75.7 | 75.8 |

| 2010 | 75.9 | 75.9 | 75.7 | 75.3 |

| 2009 | 76.0 | 76.1 | 76.0 | 75.9 |

| 2008 | 75.2 | 75.1 | 75.0 | 75.7 |

| 2007 | 75.2 | 75.3 | 75.2 | 74.9 |

| 2006 | 74.1 | 74.4 | 74.4 | 74.9 |

| 2005 | 73.0 | 73.1 | 73.2 | 73.5 |

| 2004 | 74.4 | 74.4 | 74.3 | 73.6 |

| 2003 | 73.8 | 73.8 | 73.8 | 74.0 |

| 2002 | 73.0 | 73.0 | 73.1 | 72.9 |

| 2001 | 72.2 | 72.1 | 72.0 | 72.6 |

| 2000 | 72.5 | 72.8 | 72.9 | 72.6 |

| 1999 | 72.1 | 72.0 | 72.1 | 72.8 |

| 1998 | 71.9 | 72.2 | 72.3 | 72.6 |

| 1997 | 70.7 | 71.1 | 71.1 | 70.8 |

| 1996 | 73.0 | 72.4 | 72.2 | 72.0 |

| 1995 | 74.1 | 73.7 | 73.7 | 73.7 |

| 1994 | – | – | 74.8* | 74.2 |

*Baseline measurement taken in summer 1994

While companies today have more data about their customers, the analytics employed to turn data into information are for the most part not good enough. Customer satisfaction data have certain characteristics that make it difficult to obtain accurate estimates, to pinpoint what aspects of the customer experience need attention, and to gauge the financial impact of actions contemplated. Traditional statistical methods assume normal frequency distributions among the residuals, moderate multicollinearity, and low levels of data noise. Customer satisfaction data don’t meet these assumptions.

ACSI Analytics is designed to overcome these problems and thereby turning raw data into financially relevant information by:

- Separating signals from noise

- Moving from correlations and artificial intelligence (AI) patterns to cause-and-effect interpretations

- Calibrating measurement instruments toward profitability

Data is not the same as information—especially not data from consumer surveys. Management decisions require information; raw data must be filtered in order to be useful for decision-making. ACSI technology filters out data noise.

Management decisions require cause-and-effect information—something that current CX tools, whether based on AI or descriptive statistics, don’t provide. ACSI Analytics, on the other hand, is based on a causal model.

There is a wide disparity in the amount of consumer data collected by companies today. Some data suppliers use surveys with more than 200 questions per respondent, while others focus on responses to a single question. Neither is appropriate. Excessively long surveys may lead to straight-line responses. Good measurement techniques—whether in the social or physical sciences—typically require several measures (survey questions in this case) per product feature or service dimension.

Accuracy and relevance are what matters. To contribute to the business objectives at hand, the measurement instruments need calibration in ways similar to the physical sciences. This is why companies with high scores in the American Customer Satisfaction Index, which is calibrated to maximize customer loyalty, are financially successful, most notably in terms of stock returns and profitability.

No advertising or other promotional use can be made of ACSI data and information without the express prior written consent of ACSI LLC.