ANN ARBOR, Mich. (February 26, 2019) – The customer satisfaction results are in, and they do not bode well for the retail sector.

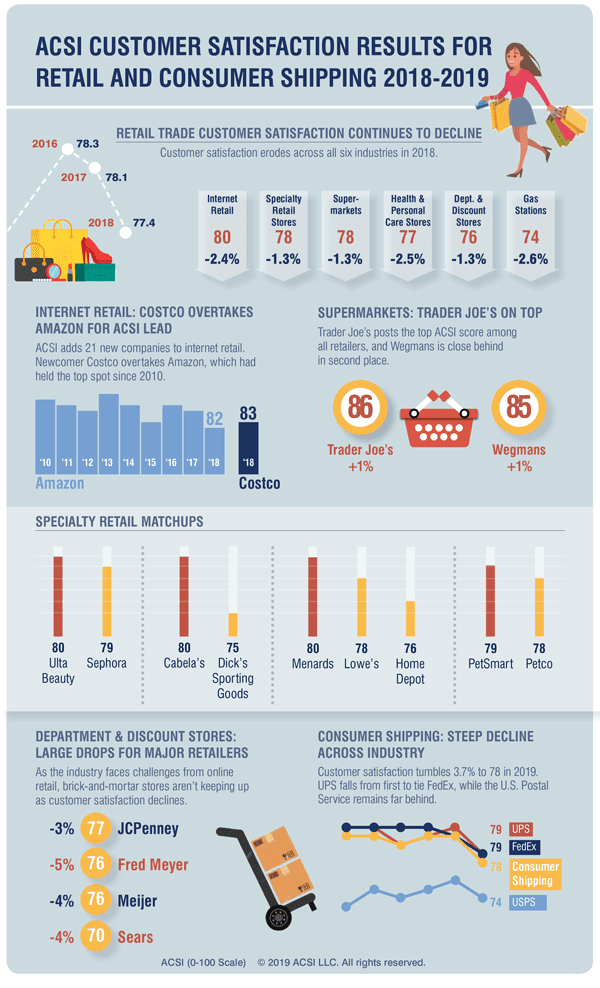

Customer satisfaction with retail is down for the second straight year, as the Retail Trade sector slips 0.9 percent to a score of 77.4 on a scale of 0 to 100, according to the American Customer Satisfaction Index (ACSI®) Retail and Consumer Shipping Report 2018-2019.

This report covers six retail categories—department and discount stores, health and personal care stores, specialty retail stores, supermarkets, internet retail, and gas stations—as well as consumer shipping.

The latest ACSI retail results are clear: Customer satisfaction is down across the board. Among the six categories, gas stations take the biggest hit, falling 2.6 percent to an ACSI score of 74. Although customers prefer online shopping to all other types of retail, even e-commerce shows signs of strain, dropping 2.4 percent in the past year.

“There is a slump in customer satisfaction in every category of the retail sector,” says David VanAmburg, Managing Director at the ACSI. “Internet retail versus brick-and-mortar retail, department stores versus specialty stores, it’s all down. Considering the importance of retail to overall consumer spending, this decline is a big deal.”

This widespread deterioration in retail customer satisfaction is due, at least in part, to underwhelming customer service. With low unemployment typically accompanied by greater employee turnover, retailers have to find and train new employees and deal with staff shortages, putting a strain on customer service.

“Historically, the ACSI has found that the more service typically required for a given industry, the lower the customer satisfaction, and it rings true for retailers this year,” says VanAmburg. “Things like courtesy and helpfulness of store staff, call center support, and even availability of merchandise on the shelves all have a service element and have seen drops from a year ago.”

Costco, not Amazon, rules the internet retail kingdom

The internet remains the preferred method of shopping for consumers despite falling 2.4 percent to an ACSI score of 80. This decline, however, is not the biggest news to hit the industry, as a new leader takes its place at the front of the pack: Costco, which scores 83 on the ACSI scale.

Costco is the value leader among online retailers and its Kirkland brand may be part of the reason why, offering quality products at a lower price.

After holding the top spot since 2010, Amazon retreats 4 percent to 82. Its retail business growth slows with the acquisition of Whole Foods. The e-commerce giant matches the combined score of smaller online retailers, up 1 percent year over year. eBay (down 1 percent), Overstock (down 1 percent), and Newegg (down 4 percent), all slide to tie at 80.

Along with Costco, there are 20 other companies in ACSI’s internet retail category for the first time. Among the debuting companies are Etsy, Kohl’s, Nordstrom, and Nike, which all tie at 81. Target, Macy’s, Wayfair, Apple, and the HP Store come in at the industry average of 80. Dell trails at 79, but Walmart and Sears anchor the bottom of the category at 74 and 73, respectively.

Trader Joe’s and Wegmans making moves among supermarkets

While customer satisfaction with supermarkets sinks 1.3 percent to an ACSI score of 78, two companies make strides: Trader Joe’s and Wegmans.

Trader Joe’s rises 1 percent to 86, making it number one among supermarkets—and all retailers, including e-commerce. Wegmans’ 1 percent improvement gives it an ACSI score of 85.

Publix falls 2 percent to tie with Aldi (unchanged) at 84. Costco remains steady with a score of 83, but most other large chains falter. H-E-B slips 1 percent to 82, and Sam’s Club (Walmart) drops 2 percent to 80.

Whole Foods sinks 2 percent to 79 despite its acquisition by Amazon. This puts Whole Foods in a tie with BJ’s Wholesale Club (down 1 percent), Hy-Vee (down 2 percent), Kroger (down 2 percent), ShopRite (unchanged), and the combined score of smaller supermarkets (down 2 percent).

The biggest decrease goes to Southeastern Grocers, which falls 3 percent to 76. However, Walmart continues to sit at the bottom, dropping another 1 percent to 72.

Costco leads department and discount stores, while Sears takes major tumble

Customer satisfaction with department and discount stores falls 1.3 percent to an ACSI score of 76, as the industry struggles to adapt to the shift to online shopping. In-store customer service also fails to live up to expectations.

Despite the industry downturn, membership-based warehouse stores are finding success. Costco leads the category, stable with a score of 83, and Sam’s Club follows suit, unchanged at 80.

Following weaker-than-expected holiday sales, Nordstrom drops 2 percent to an ACSI score of 79. BJ’s Wholesale Club (down 1 percent), Dillard’s, and Kohl’s (both unchanged) also come in at 79. Meanwhile, Belk is among the few stores to improve, up 1 percent to 78 as its rollout of “Beauty Bars” to 500 stores helped attract customers and boost sales.

Fred Meyer (Kroger) takes the biggest hit in the category, tumbling 5 percent to 76. Also at 76, Meijer drops 4 percent, while Sears finishes at the bottom of the category following a 4 percent decline to 70.

It’s not all bad for department and discount stores, as shoppers take notice of their efforts to embrace mobile shopping apps, scoring 82 for quality and 81 for reliability of the apps.

L Brands takes year-over-year hit; still leader among specialty retail stores

Despite dropping 1.3 percent, specialty retail stores continue to top department and discount stores with an ACSI score of 78.

L Brands (Victoria’s Secret, PINK, Bath & Body Works), coming off its record high the year before, plummets 4 percent to 82, yet remains the category leader. The company’s stock fell almost 56 percent in the past 12 months.

Beauty retailers Ulta Beauty and Sephora make their ACSI debut this year. The former holds a slight edge over the latter, 80 to 79, with Ulta showing an advantage for both the quality and value of its product offerings.

Ascena (Ann Taylor and Loft) is among the few stores to see an uptick in customer satisfaction, up 1 percent—for the second straight year—to 80. Michaels (79), Gap (78), and Petco (78) each experience a 1 percent boost as well.

Dick’s Sporting Goods (75) and GameStop (74) hold the bottom two spots, dropping 4 percent year over year. Both establishments fall victim to changing buying habits, as customers seek to buy the merchandise online for less.

Customers continue to prefer smaller drug stores

Satisfaction with health and personal care stores retreats 2.5 percent to an ACSI score of 77.

Amazon’s $1 billion purchase of prescription-management startup PillPack doesn’t change the fact that customers still prefer smaller drug stores. But the lead is shrinking.

Smaller drug stores fall 2 percent to a combined score of 82, just ahead of second place Kroger, a customer favorite among the large chains, which improves 1 percent to 81.

Among the big-name stores, CVS and Walgreens each score 77, with the former falling 1 percent. Kmart (Sears) takes a 5 percent tumble to 76, drawing even with Rite Aid (down 1 percent). A 3 percent drop places Walmart at the bottom with an ACSI score of 73.

UPS no longer sits alone atop consumer shipping category

Satisfaction with consumer shipping takes a dive, down 3.7 percent to an ACSI score of 78.

UPS loses its sole grip on first place, falling 4 percent to match FedEx (down 2 percent) at 79. The U.S. Postal Service continues to lag far behind after falling 3 percent to 74.

Things are even worse for the Postal Service’s regular mail delivery, which drops 4.1 percent to 70 after three consecutive years of stability.

The ACSI Retail and Consumer Shipping Report 2018-2019 on department and discount stores, specialty retailers, health and personal care stores, supermarkets, internet retail, gas stations, consumer shipping, and the U.S. Postal Service is based on interviews with 62,486 customers. Respondents were chosen at random and contacted via email between January 16 and December 26, 2018, for all industries except internet retail, which represents the holiday shopping period only (October 8 to December 26, 2018).

This press release is also available in PDF format.