Samsung Galaxy Note 9 Is America’s Favorite Smartphone

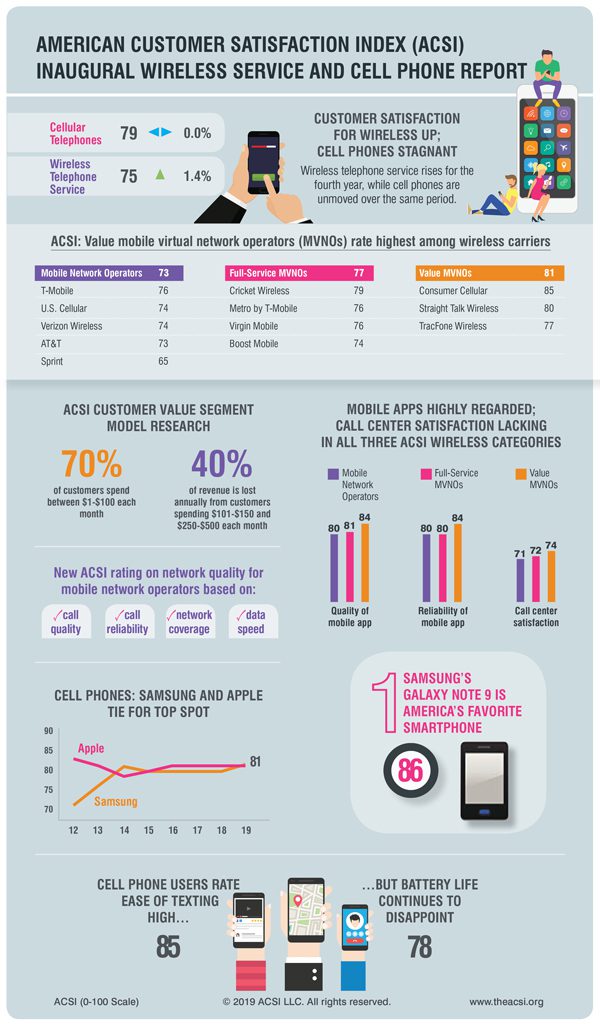

ANN ARBOR, Mich. (June 4, 2019) – As wireless telephone service readies for a major transformation, customer satisfaction with the industry climbs 1.4% to a score of 75 (on a scale of 0 to 100), according to the American Customer Satisfaction Index’s (ACSI®) Wireless Service and Cellular Telephone Report 2018-2019.

This inaugural report covers three new categories of wireless telephone service providers—mobile network operators (MNOs), full-service mobile virtual network operators (MVNOs), and value MVNOs—as well as cellular telephone manufacturers and smartphone brands. The ACSI also introduces new metrics for network quality as well as customer satisfaction by spending level.

Smartphone sales are leveling off as more customers wait to upgrade devices. Longer phone lifecycles play a role, but there’s also an increasing desire to wait for innovations like 5G technology.

“To cope with the rapid growth of wireless data traffic, carriers are investing in modernizing infrastructure, including 5G networks,” said David VanAmburg, Managing Director at the ACSI. “Samsung’s newest Galaxy S10 smartphone is a major step toward enhanced 5G connectivity. This may help build a foundation for future 5G devices, as it will be the first time a phone can access 5G without an attachment in the United States.”

T-Mobile tops customer satisfaction among MNOs

The lowest-scoring category in the wireless telephone service industry is MNOs with an ACSI score of 73. Growth of network devices slows, while wireless revenue declines for the second straight year, falling 5% in 2018.

T-Mobile, which reported its best three months ever, leads all MNOs in customer satisfaction with a score of 76, as it bests the competition in value and ease of billing. The carrier also outpaces the others in subscriber growth.

Although T-Mobile is seeking to merge with Sprint—the lowest-scoring network operator—to compete with the likes of Verizon and AT&T, ACSI data show mergers typically stifle customer satisfaction, at least in the short term.

Verizon Wireless and U.S. Cellular tie for second place at 74. AT&T matches the category average with an ACSI score of 73.

While Sprint finishes last at 65, it exceeds new subscriber expectations thanks to promotions and giveaways. However, Sprint lost 189,000 monthly phone subscribers during its fiscal fourth quarter—the carrier’s most valuable customers—and its mobile app rates last in the category in both quality and reliability.

Verizon stands out for network quality

The ACSI introduces a new rating of network quality based on customer evaluations of call quality (clarity and strength), call reliability (dropped calls), network coverage, and data speed. Verizon Wireless leads this category with a score of 80. AT&T is next at 78. T-Mobile and U.S. Cellular score 77, respectively. Sprint again brings up the rear with a network quality score of 72.

MNOs thrive at in-person customer service: Staff courtesy and helpfulness is the highest-scoring aspect of the customer experience at 81.

MNOs succeed with mobile apps as well. While scores vary widely among companies, the category comes in at 80 for both quality and reliability. Customers prefer mobile apps to websites, with website satisfaction scoring slightly lower at 79.

Customers admit the worst aspects of network service are data speed and call centers, which score 76 and 71, respectively.

Cricket Wireless ranks best among full-service MVNOs

With an ACSI score of 77, customer satisfaction with full-service MVNOs is dramatically higher than the rating for MNOs.

Cricket Wireless—part of AT&T’s prepaid portfolio—leads the category at 79 and just passed the 10 million subscriber mark. Customers feel Cricket Wireless offers the best range of wireless plans among full-service MVNOs.

Metro by T-Mobile and Virgin Mobile (a subsidiary of Sprint) tie for second place at 76, while Sprint’s Boost Mobile comes in last with score of 74. Boost Mobile’s issues may lie in device compatibility; services will only work on Boost Mobile devices and some certified Sprint devices. ACSI data show Boost ranks lowest in the category in terms of dropped call frequency.

Full-service MVNOs do well in most aspects of the customer experience. Straightforward payments are vital for prepaid customers and ease of billing holds the top mark of 85. Mobile apps score well in terms of quality (81) and reliability (80). In-person customer service is also a plus for the category, with staff courtesy and helpfulness at 82 and service speed at 80.

According to customers, call centers are the poorest aspect of full-service MVNOs, with a score of 72.

Consumer Cellular leads value MVNOs – and all carriers

Customer satisfaction with value MVNOs is the highest among the wireless categories at 81. Consumer Cellular, which leads the category with an ACSI score of 85, also tops all carriers across the board. Its customers appreciate the ease of billing that comes with offering no-contract, postpaid service and discounts to AARP members.

Straight Talk Wireless comes in second at 80. TracFone Wireless finishes last with an ACSI score of 77 and lags behind for data speed and reliability.

Value MVNOs score an industry-best 89 in billing. In general, these customers have a higher regard for all aspects of the customer experience compared to customers of both full-service MVNOs and MNOs.

All elements of the value MVNO customer experience score in the 80s, save for call centers, which score 74.

Introducing new measure of customer spending

The ACSI also asked respondents how much they spend each month for their wireless service. The Customer Value Segment Model allows differentiation among customer groups based on how much each spends on their wireless service, along with variation in satisfaction and loyalty. The model then targets those segments where the financial return from investing in better customer satisfaction is strongest.

For instance, while almost 70% of customers note a spending level between $1 and $100 on their wireless bill, these customers account for no more than 35% of carriers’ revenue. Meanwhile, customers that spend $101-$150 and $250-$500 make up only 18% of the customer base but more than 36% of total revenue. However, because the latter higher-spend groups are less loyal and have lower customer satisfaction, they account for nearly 40% of the revenue lost to customer churn across the wireless service industry each year.

Samsung pulls even with Apple among cell phones

For the fourth consecutive year, customer satisfaction with cell phones is stagnant at 79. The market is saturated, and customer satisfaction with mobile devices remains unchanged because of a combination of high expectations and a lack of industry innovation.

Following a 1% jump, Samsung moves into a first-place tie with Apple at 81 despite smartphone sales dropping for both companies. Apple iPhone sales are down 17% for the first quarter, a potential issue for Apple as ACSI data show the company’s value is lacking compared to other manufacturers.

Among brands, Samsung’s Galaxy Note 9 is now America’s favorite smartphone with an ACSI score of 86. Customers like the powerful Android model, with its large screen and broad capabilities.

Apple’s iPhone X, iPhone 8 Plus, and iPhone SE all score 83. Three more models cluster at 83: Samsung’s Galaxy J7 Prime and Galaxy S8+, as well as Motorola’s Moto G. The lowest-rated model now belongs to Samsung with its Galaxy J3 (77).

“As Samsung’s newly released Galaxy S10 5G smartphone hits the market, it will be interesting to see how this first step and the bigger 5G rollout impacts both customer perceptions and the ACSI rankings next year,” said VanAmburg.

Customer experience shows little improvement over the last year. Cell phones are generally easy to use, with text messaging earning the top score at 85. Despite being the only area to improve year over year, battery life (78) finishes last among customer experience benchmarks.

The ACSI Wireless Service and Cellular Telephone Report 2018-2019 on MNOs, full-service MVNOs, value MVNOs, cellular telephones, and smartphone brands is based on interviews with 19,658 customers, chosen at random and contacted via email between April 5, 2018, and March 27, 2019.

This press release is also available in PDF format.