ANN ARBOR, Mich. (June 9, 2020) — COVID-19 has dramatically changed the way Americans work and how they spend their leisure time, putting a spotlight on both high-speed internet service and in-home entertainment options.

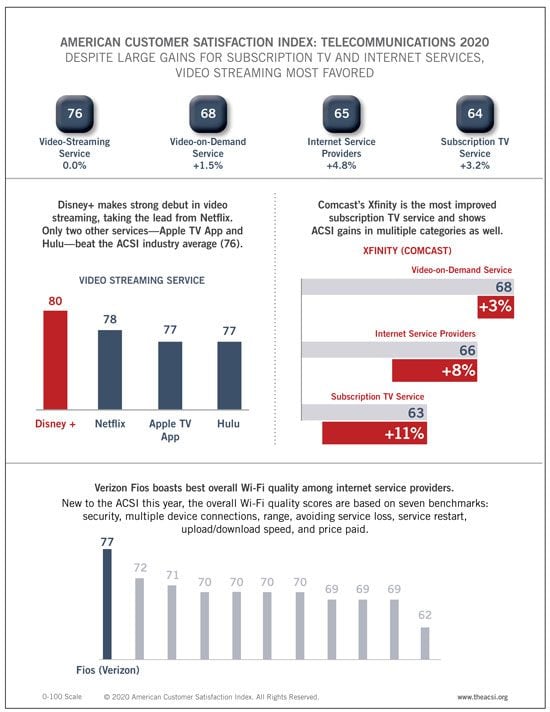

Video streaming remains the people’s choice, with customer satisfaction steady at a score of 76 (on a scale of 0 to 100), according to the American Customer Satisfaction Index (ACSI®) Telecommunications Report 2019-2020. However, other telecom categories are making moves.

Among the five telecom industries covered in this report — subscription TV service, internet service providers (ISPs), fixed-line telephone service, video-on-demand service, and video streaming service — three show significant improvement in customer satisfaction: subscription TV, ISPs, and video-on-demand.

“With stay-at-home and work-from-home becoming a new normal for many American households, the services offered by major telecommunications companies are more crucial than ever before,” says David VanAmburg, Managing Director at the ACSI. “Fortunately, many telecom companies laid the groundwork before the pandemic, offering their customers better services compared to last year.”

New to the survey this year for the ISP industry, the ACSI also measures key aspects of the in-home Wi-Fi customer experience. This includes satisfaction with both third-party and ISP-provided Wi-Fi equipment.

The force is strong with Disney+ following strong debut

Video streaming overall has the lock on customer satisfaction among telecom industries and outpaces subscription TV by 12 points.

Disney+ sets the bar with an impressive debut, securing the top spot in video streaming — and across all five telecom categories — with an ACSI score of 80.

Last year’s leader, Netflix, falls to second place, slipping 1% to an ACSI score of 78. Hulu, now controlled by Disney, and Apple TV App (formerly Apple iTunes) close in on Netflix, both up 1% to 77. The group of smaller streaming services shows massive improvement, rising 6% to match the industry average of 76, the same score as Amazon Prime Video (unchanged) and Microsoft Store (down 1%).

Four companies are just below the industry average with scores of 75: Starz (up 4%), CBS All Access (unchanged), Amazon’s Twitch (unchanged), and Google’s YouTube TV (unchanged).

Apple TV+ also makes its debut in the ACSI, but, VanAmburg says, “There’s nothing particularly ‘plus’ about Apple TV+.” The streaming service scores below average at 74, tying it with Google Play (down 1%) and AT&T’s HBO (unchanged).

AT&T TV NOW (formerly DIRECTV NOW) remains on the lower end of the industry despite gaining 4% to 72. Walmart’s Vudu drops 4% to 72, followed by CBS’ Showtime, unchanged at 71. DISH Network’s Sling TV falls 4% to match Showtime. Sony’s Crackle continues to be the least satisfying streaming service, unmoved at an ACSI score of 68.

Xfinity makes huge gain, but subscription TV still struggling

Customer satisfaction with subscription television service climbs 3.2% to an ACSI score of 64, as pay TV customers are happier overall with value. Despite the improvement, subscription TV sits at the very bottom of all 46 ACSI-measured industries. Cord-cutting accelerated in 2019, as many viewers moved to more satisfying over-the-top video streaming services.

Still, satisfaction improvement for subscription TV is widespread, with nine of 11 major companies showing ACSI gains year over year. Comcast’s Xfinity makes the most staggering jump, soaring 11% to an ACSI score of 63.

Two fiber providers top the rankings. Fios by Verizon Communications gains 3% to 70 and ties with AT&T’s U-verse TV (up 1%).

Satellite providers have seen their lead over top cable providers evaporate. DISH Network dips 3% to 65, while AT&T’s DIRECTV falls by the same amount to 64 — back to the provider’s lowest score of all time.

The remaining companies all score below the industry average of 64, but a seven-point gap separates the best from the worst. Altice’s Optimum increases 3% to 63, tying the greatly improved Xfinity. The group of smaller subscription TV providers remain unchanged at 62, the same score as Cox Communications (up 5%). Charter Communications’ Spectrum rises 3% to 61, followed by Mediacom at 60 after a 7% rise.

At the bottom of the industry, Frontier Communications — which filed for bankruptcy protection in April 2020 — inches up 2% to 58. Despite a small uptick to 56, Altice’s Suddenlink sits in last place.

Verizon’s Fios increases its advantage as Xfinity climbs among ISPs

The COVID-19 crisis showed the necessity of in-home internet as workers and students stayed home. Heading into this challenging time, satisfaction was in a good place.

Customer satisfaction with ISPs surges 4.8% to an ACSI score of 65, with eight of 11 providers showing gains.

Verizon Fios strengthens its hold atop the industry, climbing 4% to 73. According to customers, Fios is best in class for reliable service.

Despite dropping 1%, AT&T Internet stays in second place at 68. Comcast’s Xfinity comes in third following an 8% gain to 66.

Altice’s Optimum rises 3% to the industry-average score of 65. The group of smaller ISPs comes in just below the industry average, steady at 64. CenturyLink and Charter Communications’ Spectrum both post strong gains of 7% to 63. Cox Communications nudges up 2% to 61, tying it with much-improved Windstream (up 7%).

Three ISPs occupy the bottom of the industry with scores in the 50s. Mediacom gains 5% to 59, while Altice’s Suddenlink plummets 5% to 57. Frontier Communications remains last, unmoved at 55.

Customers prefer third-party equipment for in-home Wi-Fi

For the first time, the ACSI also measures key aspects of the in-home Wi-Fi experience for both customers who use equipment provided by their ISP and those who purchased third-party equipment.

Across all aspects of the in-home Wi-Fi experience, customers using third-party equipment (routers and associated hardware such as extenders/boosters) are more satisfied than those using their ISP’s equipment. For Wi-Fi security, customers using ISP-provided routers (74) are nearly as satisfied as those choosing third-party routers (75). However, the gap widens across all other elements, most notably restarting quickly after service loss (74 versus 69) and price paid (72 versus 66).

The ACSI also measures overall Wi-Fi quality for individual ISPs based on the evaluations of customers who use each provider’s equipment. Scores are based on seven benchmarks: security, multiple device connections, range, avoiding service loss, service restart, upload/download speed, and price paid.

Verizon Fios leads the field for overall Wi-Fi quality with a score of 77. Xfinity comes in second with a score of 72, followed by Cox Communications at 71.

AT&T Internet, Mediacom, Altice’s Optimum, and Charter Communications’ Spectrum all score 70. CenturyLink, Altice’s Suddenlink, and Windstream are next at 69 apiece. Frontier Communications finishes last with a score of 62.

Among third-party Wi-Fi equipment, Netgear and TP-Link tie for overall Wi-Fi quality at 75. LinkSys is next at 73, followed by ASUS at 71.

Video-on-demand services make small strides but remain no match for streaming

Customer satisfaction with the video-on-demand services of major cable, satellite, and fiber-optic subscription TV providers jumps 1.5% to an ACSI score of 68.

However, only three of nine companies improve year over year.

AT&T’s U-verse TV secures the top spot, climbing 3% to 74. Verizon’s Fios falls 1% to 71, tying for second place with DISH Network (unchanged). AT&T’s DIRECTV also slips, down 1% to 69.

Charter Communications’ Spectrum rises 6% to 68, same score as Comcast’s Xfinity, which improves 3% thanks to an increase in customer perceptions of value.

The remaining companies’ video-on-demand services are below the industry average for satisfaction. Cox Communications is steady at 66, while Altice’s Optimum recedes 2% to 65. Last place Frontier Communications takes the biggest hit, tumbling 4% to 64.

Vonage loses steam among fixed-line telephone services, Verizon Communications and Xfinity climb

As more Americans increasingly turn to wireless phone service, customer satisfaction with fixed-line telephone service wanes 1.4% to an ACSI score of 70.

Verizon Communications, up 1%, ties Vonage for the lead at 74. Despite sole possession of the top spot a year ago, Vonage took a major hit, falling 4%. AT&T is next in line at 72 (unchanged).

The group of smaller landline providers falls 3% to 71. Xfinity moves in the opposite direction, up 4% to 70.

Charter Communications’ Spectrum inches up 1% to 68, moving ahead of Altice’s Optimum, which drops 3% to 67. Cox Communications follows at 66 (down 1%). Altice’s Suddenlink rises 7% to 65, tying CenturyLink (unchanged).

At the bottom of the industry, Windstream sinks 2% to 63 and Frontier Communications falls 3% to 59.

The ACSI Telecommunications Report 2019-2020 is based on interviews with 46,504 customers. Download the full report, and follow the ACSI on LinkedIn and Twitter at @theACSI.

This press release is also available in PDF format.