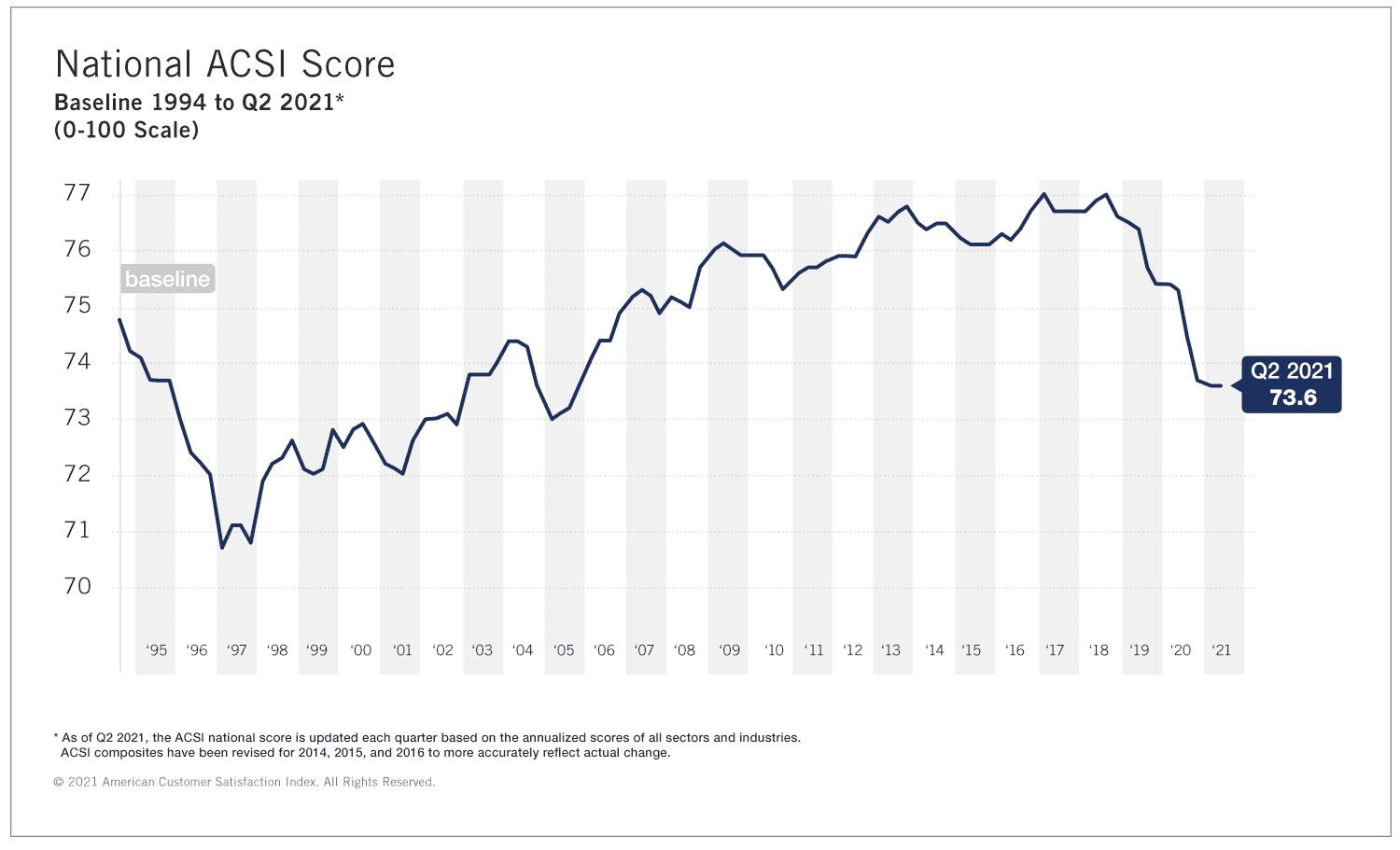

ANN ARBOR, Mich. (August 17, 2021) — Overall customer satisfaction in the U.S., tracked by the American Customer Satisfaction Index (ACSI®), showed no change – not even at the first decimal – in the second quarter of this year.

It remains at a low 73.6 (out of 100). One must go back more than 15 years to find a comparable level.

It is uncertain whether the halt is temporary. There are indications that customer satisfaction might continue to drop. While part of the problem is due to COVID, the ACSI collapse began in 2018 – well before the advent of the pandemic. Before COVID, it was also followed by weaker consumer spending and slower GDP growth.

While the level of ACSI remained reasonably stable, its rate of growth slowed much earlier – over 10 years ago with consumer spending and GDP growth following suit. The latter two have since rebounded, but not customer satisfaction. While recent GDP growth is often hailed as extraordinarily impressive, it is important to note that it is only marginally higher than the GDP level of 2019.

The reason that the relationship between customer satisfaction and household spending has been disrupted is because the pandemic led to high pent-up consumer demand. Many consumers also had the means to spend. But what then is responsible for both the sharp decline and low levels of customer satisfaction?

There are several possible explanations. One is inflation. Prices have increased overall and, in some markets – housing and automobiles, for example – by quite a bit. However, while inflation might put a damper on customer satisfaction, prices didn’t rise until customer satisfaction had already dropped.

The increase in productivity in the service sector might well be a cause of lower customer satisfaction, coupled with the fact that some service sectors have difficulty filling jobs. In other words, when companies are serving an increasing number of customers with fewer people, labor productivity increases but service quality usually suffers.

This is related to how well businesses manage the shopping, buying, and consumption experience of their customers. It is difficult enough if staffing is a problem, but the analysis of customer data is also in need of improvement. Most of it is descriptive as opposed to prescriptive. Data are noisy, patterns are mistaken for causal relationships, and performance metrics often lack relevance.

“Economic growth in an advanced economy is highly dependent on consumer spending,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “In the U.S., consumers account for about 70% of GDP. There are two requirements for consumer spending growth: willingness to spend and ability to spend. At this point, households are eager to spend, almost no matter what. It is more of a reaction to the impositions caused by COVID than a search for specific consumption gratification.”

But this is in the short term, and also is visible in the stock returns of companies with high ACSI scores. While the returns are still high, they are not much higher than the market. This is unusual. Stock returns for companies with highly satisfied customers are usually significantly higher than the market.

“Long term, this will go back to normal,” Fornell noted. “Customer satisfaction will again become critical. Satisfied customers will come back. Dissatisfied customers will not. Companies with more of the former will do better.”

The national ACSI score (or ACSI composite) is updated each quarter based on annualized customer satisfaction scores for all sectors and industries. For more, follow the American Customer Satisfaction Index on LinkedIn and Twitter at @theACSI.

This press release is also available in PDF format.