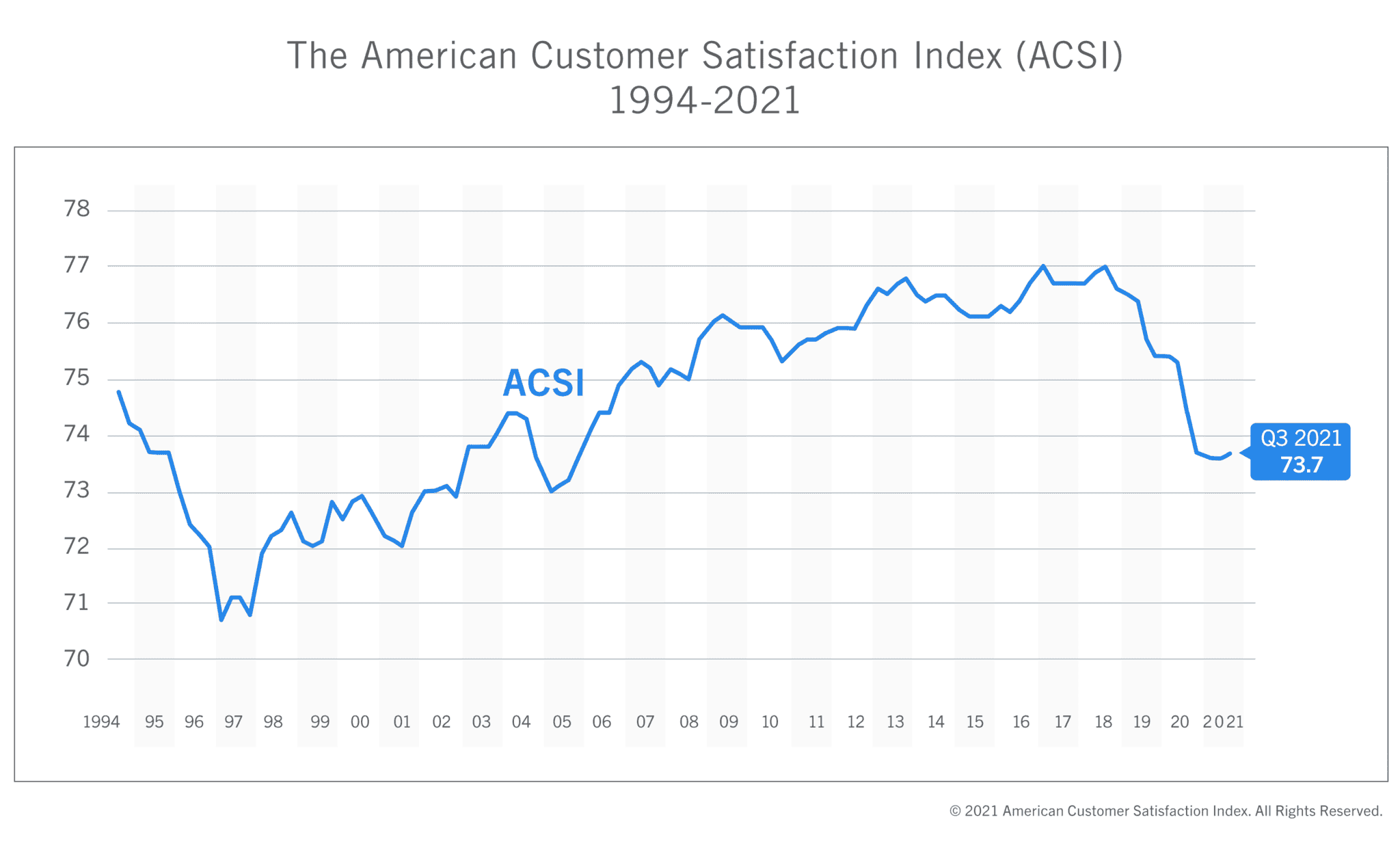

ANN ARBOR, Mich. (November 9, 2021) — Overall customer satisfaction in the U.S, tracked by the American Customer Satisfaction Index (ACSI®), remains essentially flat at 73.7 (out of 100) in the third quarter of this year.

It registered 73.6 in the second quarter – the first time since 2018 that it did not decline. This has been the longest sustained period of deterioration in customer satisfaction in 25 years.

The decline began before the advent of COVID-19, but the pandemic has accelerated and deepened it. Accordingly, certain causes are not COVID-related.

“The earlier drop in customer satisfaction followed a long period of business inability to improve the satisfaction of its customers, largely caused by failures to convert data to relevant and accurate information,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “The analytics used by most companies are not well equipped to deal with the nature and complexities of customer data. COVID has made a difficult situation even worse, with economic problems on top of the deficiency in analytics.”

The United States, and most of the world, is currently experiencing a “shortage economy.” Demand is greater than supply. As in most such situations, this leads to higher prices. Higher prices create more customer dissatisfaction. But the shortage economy is about more than price.

Due to shortages in labor, the shortage economy has had a negative effect on customer satisfaction in the service sector. Due to shortages related to supply chains for parts, it has had a negative effect on customer satisfaction in the manufacturing sector. With both inflation and shortages, where the latter is causing the former, it is easy to understand why customer satisfaction has deteriorated. The good news is that satisfaction may have reached its low. The past two quarters have not seen further decline in ACSI.

While there are many companies in industries affected by labor and supply shortages, there are some that have been less impacted and have actually succeeded in increasing the satisfaction of their customers. Most of them are in the communications business, such as landline phone service, internet service providers, and subscription TV. Companies in these industries have been less affected by labor and parts supply problems.

In terms of the economy at large, as with the situation regarding customer satisfaction, the bleeding may have stopped, at least for now. GDP growth has been positive for a year now. Its largest component – consumer spending – is also positive, but at 1.6% growth, it is much weaker than would be necessary for healthy economic growth. However, consumer spending and customer satisfaction have gone hand-in-hand over the past decade – both weak.

In the short run, there is so much pent-up demand that customer satisfaction will probably be less of a driver of spending – in the aggregate, availability of goods and services will. Differences between companies in customer satisfaction will affect market shares but probably have a lesser effect on economic growth until the shortages in labor and parts are eliminated.

The national ACSI score (or ACSI composite) is updated each quarter based on annualized customer satisfaction scores for all sectors and industries. For more, follow the American Customer Satisfaction Index on LinkedIn and Twitter at @theACSI or visit www.theacsi.org.

This press release is also available in PDF format.